Hindenburg Report Alleges Adani’s 6 Biggest Mistakes

Adani, India’s most controversial person. Whatever is said about him becomes a political statement. Because whoever supports Adani, they support Modiji, and whoever is against Adani, they are against Modiji as well. today, this is the truth everyone, Did the Hindenburg report expose Adani?

on 24th January 2023 named Hindenburg published a lengthy report to destroy Adani group. This is the business of this research company. First, they target a company and then take a short position on it to see how much the market value of that company falls. That is the profit that this company earns. This is our Adani trilogy, where we will answer three questions.

What does the Hindenburg report say?

In this report, Hindenburg has raised six big points, out of which some are valid, some are controversial, and some are so nonsensical that I think some intern has written it who cleared his exam after many failed attempts. because they have huge gaps in logic. We will divide these six points into three parts: valid, controversial, and nonsensical.

Point No.1: Adani violates SEBI’s rules, hold shares more than the limit. SEBI says that in a public company at least 25% holding must be public. If we initiate an IPO of “Apple,” then we as founders and our promoters can’t hold more than 75% of the company. A report says that Adani is playing a game. In his company, almost 75% is owned by him and his promoters, and much of the remaining 25% is held through shell companies.

Point No. 2: Ketan Parekh had fooled the stock market. in 2003, SEBI banned him for 14 years and for 14 years, he was banned from in stock market with the help of companies linked to Ketan Parekh, Adani has increased the prices of his shares this is what Hindenburg says.

Point No.3: Adani does a lot of foul playing, Adani has 7 listed entities, they have 578 subsidiaries and it has 6025 related party transactions. Hindenburg says that Adani Group doesn’t show some transaction, and some transactions which it shows, it doesn’t have any basis or value.

Point No. 4: The report says that Adani is the factory of scams; their CFOs change like trending reels. Such a big company’s audit is done by a small company with 11 employees. This company is so small that its office rent is just Rs. 32,000.

Point No. 5: There are many different charges against Adani, and the central agencies investigate them, but due to some miracle, Adani gets out of all this.

Point No. 6: Research houses don’t do research on Adani, and mutual funds don’t invest in the Adani group. which means something’s fishy. These are such big claims that it seems like this is not “Adani,” but “Laxmi Chit Fund.” But how much of it is there?

Is Hindenburg lying?

In short, no, they are not lying, but they are exaggerating some points. Their understanding of Indian accounting standards is equal to that of civil engineering students about girls. Let’s divide the major claims of this report into three sections.

- Red: Red are concerning valid claims, which really need to be investigated.

- Yellow: Yellow mean contentious claims, which has some ambiguity, our laws and and our corporate governance lack some clarity. there are loopholes, and advantages of this are taken by companies like Adani.

- Green: Green means stupid claims.

Stupid claims

First, let’s talk about those points that make no sense. Hindenburg’s founder says that he likes to research, but if he applies to our company for research with “Apple,” then we will kick him out, why? Because his strategy is simple, he has to reach a conclusion and then reach that conclusion. He takes any path; their conclusion comes first and their research comes later. let understand through an example they wanted to prove that, few analysts research about Adani’s companies and to prove this they took one Adani company. They saw how many people had researched them and started looking for another company of the same size that had been researched and analyzed by other companies.

Let’s look at their report itself. Adani Green has been covered by 1 analyst, and Bajaj Finance has been covered by 33 analysts. Adani Ports has been covered by 22 analysts, and Mahindra & Mahindra is covered by 48 analysts. It looks like Adani is not being covered by analysts. Investment bankers are not interested in them. which means there is something fishy. But if they wanted to prove this, then they must compare it with a company working in the same sector; if one compares it with a company in a different sector, then how will the apples to apples comparison happen. Adani Green is a renewable energy company, Bajaj Finance is a finance company, Adani Ports operates ports, and Mahindra & Mahindra makes automobiles. It is like comparing Rohit Sharma with Usain Bolt and watching who runs faster. If Usain Bolt can run so fast, then why can’t Rohit Sharma? Hindenburg assumes that a proper investigation is not done on Adani; 40 other companies, along with Adani, were investigated for inflating coal’s value. But the investigative agencies here sent letters of request to foreign countries to get information, but the court just said that you don’t have the authority to ask for information from other countries, and on this basis, the case was thrown out.

On one side, Hindenburg blames Adani that, to audit their accounts. They hire a small company, and on the other hand, the PAN card details of its partners are publicly exposed by them. No matter what, publicly exposing the PAN card details of anyone is a breach of privacy. Pan card is a sensitive information, which can be used for scams this was done only to prove that, these auditors are so young, how will they know how to audit? Well, ICAI has given them the degree, so is Hindenburg also questioning the CA institute? Having only 11 employees or paying less office rent doesn’t indicate that the company is fraudulent or is helping to hide a scam. In the history of Indian scams, many big audit firms helped in covering up the scams. So despite having a big financial company where scams can be covered up, this shows that Hindenburg researchers have very little knowledge of Indian accounting standards and procedures. They have a disease of jumping to conclusions first, like our teachers used to say that for an 8-mark question in an exam, if you write a lengthy answer, you will get more marks. Then we repeat the same point again and again. This also seems like it.

Contentious claims

Now to the ambiguous points: reports say that Adani is rolling its money into their own companies and hiding its losses. Here we need to have a look at the Indian Accounting Standards. Every company has to follow some standards, and IND AS 24 defines related-party transactions. Let’s take an example of a reputed company. TATA is a conglomerate; it works in different sectors. So suppose TATA Power wants to make software, and if it goes to TCS and is passed on to them, then this is a related-party transaction.

Now the question is: is this illegal? not at all. but it is important to disclose. Why is it important? just thinks, if 80 to 90% of TCS’s business is coming from TATA companies only. then as a investor, as a bank, as a regulator you must know that this money is rolling in the same company. It may happen that you are an investor in TCS but not in TATA Power. If TATA Power faces some problems tomorrow, then its impact is going to be felt by TCS. Because TCS is overly dependent on TATA companies, disclosures are important, and that’s the point.

Valid claims

Let’s come to Adani’s case. Vinod Adani is Gautam Adani’s brother. Vinod Adani started a company named Krunal Trade and Investment. they gave a real a real estate company named Sun Born in 2009, a loan of Rs. 1171 crores. in 2020, this company gave Adani enterprise a loan of Rs. 984 crores and Adani had disclosed that, this is a related party transaction. Hindenburg’s report says that they must also show Krunal Trade and Investment as a related party, whereas between Adani and Krunal Traders there is a direct transaction. Hindenburg assumes that the relationship between Krunal Traders and Adani Enterprises is mandatory to be shown. but our accounting standards state that, just because Krunal Trade and Investment was started by his brother, this doesn’t mean that he automatically becomes a related party. now this comes in the yellow part because, firstly our accounting standards need to change or the courts need to define what is related party?

Now let’s come to the most important section, the serious claims. amongst this, even if one claim is true, then Adani’s scam is really a very big scam. point no.5 comes in the parts, those Adani’s issues and scandals, which has no result yet our system is slow judiciary is not able to take action in time. and we are very lenient; this is the truth. We can’t ignore this; quite frequently, cases against Adani are dismissed for lack of evidence. A lack of evidence doesn’t mean that the allegations are false, but the responsibility of finding the right evidence and presenting the case correctly lies with the authorities. This is the biggest allegation, and if true, then a pattern is visible. which is very dangerous for India.

Today it is Adani, tomorrow it can be someone else. Then comes point No. 2, linking with Ketan Parekh and trying to manipulate its own stocks. SEBI had prosecuted the Adani Group in the past; they had links with Ketan Parekh. The SRBI order says that in 1999, Adani Company sold their shares to Ketan Parekh, and Ketan Parekh did “circular trading.” Price matching happens in the national stock exchange. Usually, what happens is that if a share’s price is Rs. 50, then the seller adds Rs. 50 as a price, and the buyer also adds the same price. Price and quantity are matched, and then the orders are executed. but in Circular Trading on purpose instead of Rs.50, sell order of Rs.60, Rs.70, and Rs.80 are added. and the same person from a different fake account also places the buy order of Rs.80 and thousands of orders like these are placed in NSE again and again. The system thinks that if people are able to sell the share even at this high price, then let’s increase the share’s price. But who is actually increasing the price? Ketan Parekh, who had artificially increased the prices of companies like Adani in the past. He had manipulated it.

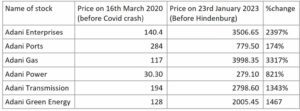

now from 2020 till date, let’s look at how the prices of Adani’s company has increased, this date is of 23rd January, before the Hindenburg report 2300%, 3300%, so much of price increase only in 2 years is very odd and Adani has a history with Ketan Parekh and after knowing this, it seems that what they did in 1999, they have done the same thing now. Of course, this is pure speculation because Hindenburg has no proof about it. Adani is growing, and that growth is too exponential. Before 2014, Adani was the 600th richest man in the world, and before this report came, he had become the 3rd richest man. How did this magic happen? because of debt.

Here comes the biggest point, which has been ignored by everyone. the biggest red flag. When a company takes a loan, then its promoters can pledge their shares, the way you can mortgage your gold and take loans. the same way promoters can pledge their shares and take loans. This is known as “pledging of shares” here; suppose you want a 1000 crore loan, then shares worth at least 2000 crore must be mortgaged. which means you get a loan for only 50% of the value of your share, and that’s the game. If Adani has manipulated the shares and increased the price artificially, then the banks that have given loans to Adani have no value; they just have an inflated value. of course that is only if Adani’s share fall, if share price don’t fall, then banks don’t care about Adani’s value. The only thing that matters to them is what the value of Adani’s shares is.

Consclusion

It’s important because it helps us understand the truth and the baseless points around this topic. Through this, we also get to know the flaws in the Indian system, and that should be the biggest takeaway from this. Because the truth is that Hindenburg is a short-selling company, what matters to them most is How many irregularities are there in the company, and after knowing this, how much do the people panic? And it happened somewhat like this: people panicked about it, share prices fell, the prices of US bonds fell, and Hindenburg earned billions of dollars. The important point is this: “Is Hindenburg right or wrong?” must be clarified through a report by SEBI.