Government’s plans in Indian Budget 2023-24

Your hard-earned money is wasted by the government. Where is your tax money spent by your leaders? Despite having so many rich people, why is there so much poverty in India? I am sure sometimes such questions, must have come in your mind. But today is such a day where every person in the country can answer all of their questions by just reading a document.

this is Indian Budget 2023-24. For our economy, it is the most important day of the year. But for many of us, the budget seems complicated. because we never taught about it in schools. So let’s understand: how is India’s budget made? And how does it matter to us?

How is the Budget Made?

Basically, there are three points in the budget.

- How much money does India earn?

- How much money is India going to spend?

- Where will our focus be next year?

To make India better, what are we going to do? Just remember these three points. these questions seem simple, but prepare answers to these questions, it takes 6 months. The work for this year’s budget was started in August 2022 itself.

Firstly, the Finance Ministry issues a circular, and all the other ministries are asked to give an estimate of how much money they will need in the coming years. All these ministries look at their expenses from April 2022 to August 2022, estimate how much additional money will be required for projects in the coming years, add it, and send it to the Finance Ministry. The Finance Ministry also comes out with an estimate as to how much GDP should grow next year. then these two figures reach the top officials and after getting approval. the work of making a budget begins. If we look at it, this process can be completed in a month as well, but our Finance Ministry consults with many other stakeholders like businesses, trade bodies, farmer unions, etc. they consider their suggestions and only them the final budget is made. At the end of the day, the finance minister and prime minister discuss and create the final budget document. and after this budget document is finalized. They prepare a halwa; they literally make halwa, and this halwa is distributed to members of the finance ministry. This document is presented in parliament on February 1, and before that, it is kept confidential. Think about it. Imagine how much the whole country is going to spend if this news is leaked in the market. then, people un the market will invest in those areas only, where profit chances are high. This information leaked into the market can be dangerous for the country. that’s why people who have worked on the budget, that budget department is locked. and once the budget is presented, only then are they allowed to get out.

How is the Budget Presented?

Every year on February 1, the budget is presented in parliament. But a day before this update, what is happening in India’s economy? How India’s economy performed last year—these things are mentioned in the economic survey and are placed in front of the people. How much inflation was there last year? What were the figures for foreign trade? How much of a loan did we take? These things are disclosed publicly. You can access this economic survey here: www.indiabudget.gov.in.

On February 1st, our Finance Minister presents the budget to the parliament. There are two parts to this budget. The first part is budget speech and announcements, and the second part is accounts.

- Announcements: In the Announcements parts, India’s roadmap is announced. this is a general direction, in which direction India’s policy will be made. There are two types of announcements. 1. There are general announcements. 2. There are specific announcements. for example, last years India promised, to provide in all villages broadband internet connection. Through the BharatNet project, the work of laying broadband cables has started. India wants that by 2025, Broadband internet should reach in every village. India wants to be a leader in solar power and by 2030, 280 gigawatts of energy. it plans to make from solar energy; for this, Rs. 19,500 crore were additionally allocated in last year’s budget.

- Accounts: We talk about accounts, and that’s the part where we all keep an eye on it. Have the taxes been reduced? Did we get other ways to save tax? All these details are there in the finance minister’s speech.

Remember two important questions: how much money is India going to earn? And how much money is India going to spend? impact of these two questions happens to you and to me. because of this, our taxes are made. Based on these questions in the accounts, three documents were made.

- Receipt Budget

- Expenditure Budget

- Demands for grants of Central Government

before understanding these three points. Let’s quickly understand one concept: what is the difference between capital and revenue? If you haven’t studied accounting in college, these terms may sound difficult to you. but if we understand it through an example, then actually these terms are very simple. Capital means one time, then if it is the Capital expense, then the expense occurring one time and if it is capital receipt, then one time occurring receipt.

Suppose a new airport is coming up in Mumbai, so what will the cost of building the airport be?? so that is Capital Expense. similarly, as Pakistan is taking a bailout from the IMF. If we take a loan, then that loan would be given only once. It won’t happen that every year the loan keeps on coming, so this is capital receipt, and the opposite of this is revenue. “Revenue” means recurring. The electricity bill has to be paid every month; last month’s bill was paid, but this month a new bill will be coming. Similarly, all those expenses of the government that are on a recurring basis are revenue expenses. One of the best examples of this is salary. similarly, every year the government earns money in the form of taxes. This is recurring income for them. which means these are revenue receipts. Now that this is clear to you,

Now let’s come back to those 3 points: receipt budget, expenditure budget, and demands for grants from the central government.

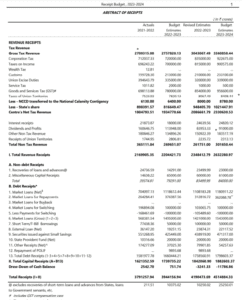

- Receipt Budget: In the receipt budget, A complete list comes out, saying that in the coming years, the country must get how much money and from where? this includes income tax, GST & Customs duty, fees & Penalties, loans & Grants.

- Expenditure Budget: Where is our money going to be spent in the financial year 2023–24? This plan is presented. You can access it here: www.indiabudget.gov.in.

- Demands for grants of Central Government: it is presented that, how much money was asked by which ministry and for which works?

Ministry of consumer affairs, food and public distribution, distributes food grains among poor people at Rs.1 to Rs.2, now these food grains are bought on MSP and is distributed at just Rs.1 or Rs.2, which means tax payer’s money is spent twice. Next year, over 80 crore people will get food grains for free from the government. This year, this ministry asked for Rs. 230000 crore, and Rs. 205000 crore was allocated to it.

Money is limited in India, so there is a competition in every ministry as to how much money is allocated where. Now you understood what a Budget means from all Tax Announcements of this Budget a finance bill is made, and once this bill is passed in Parliament. If an act is formed without the parliament’s permission, the government cannot use your money. The government needs parliament’s approval, which they get through the appropriation bill. Through this bill, money is given to every ministry.

Why is Budget important?

We are always thinking, “I pay tax, I pay income tax, and I also pay GST.” So what happens to this money? Why are good roads not being built? Why are the problems not fixed? to understand this budget is an excellent source, Because through that we know, where most of our money is spent? India creates a deficit budget, which means our expenses are greater than our income. and this gap is filled by the government by taking out loans, and on these loans, interest is to be paid every year, which means even after paying so much tax, still India never has the amount of money required.

Where does our money go?

let’s look at our budget closely and let’s understand, where does our hard earned money go? Let’s have a look at the union budget’s accounts. Let’s go through the receipts in the budget. In the next year, how much money will we earn? As per the receipt budget, through taxes, we will earn Rs. 33 lakh crore. Out of this, 10 lakh crore will be distributed among states so that they can work on their state projects. Overall, the center will get tax revenues of Rs. 23.3 lakh crore. This is expressed by the central government. Non-tax revenues are 3 lakh crore, so in total 26 lakh crore can be spent by us.

Now in the Indian Budget 2023–24, Nirmala ma’am said that our expenses will be Rs 45 lakh crore. we don’t have that much revenue, the remaining 19 lakh crores we have to borrow, now lets have a look at Expenditure budget. highest allocation is made to ministry of Finance and in which interest payment on loan is a very high figure of Rs. 10,79,000 crores. The second number is the Ministry of Defense, with Rs. 5,93,000 crore. army, navy, and air force; all three are included here. Capital outlay here means weapon upgrades, new equipment, etc., and if you look at it carefully, we give a significant amount through defense pensions. next is ministry of consumer Affairs, food and public distribution, which procures food grains on MSP and gives it for public distribution. There is one important ministry, the ministry of fertilizers, because we give subsidies on fertilizers too. For this ministry, the budget is Rs. 175 crore. Let’s focus on home ministry; now all union territories and police forces come under them. so you can see that one amount is sanctioned for each UT.

In this budget session, two ministries got high allocations, namely, railways and roads, which both got high allocations for capital expenditure. One good thing about this budget is that our capital expenditure is very large. When we spend on infrastructure, the returns are greater and over a longer period. Experts say that for every rupee spent, we get Rs. 2.5 back. that’s why if we don’t want to take the country ahead. then we have to increase our capital expenditure and, as much as possible, decrease our revenue expenditure.

Conclusion

The main problem with India is that India’s tax base is very small when it comes to paying taxes. So India ranks 116th; only 2% of Indians pay tax; this number is 15% in China and is 80% in the US. This is the reason why these countries can make rapid progress. which means the earning hands are fewer and the consumers are too many. As a result, we have to take the loans.

2 thoughts on “Indian Budget 2023-24”