If Hindenburg’s report turns out to be true, what will happen to Adani?

What if Adani fails? India’s seven big airports will fail, 13 ports will stop working, and who will provide electricity in Mumbai? We don’t know. What will happen to our solar power? We don’t know. Adani cannot fail because it is far too large to fail. If Adani fails, it will impact the whole of India, and there will be a full stop to India’s progress for the next 10 years. Adani’s success is linked with India’s success, but do you think this is correct? Do you think we must be so dependent on one business house? and if one business bouse is becoming so big, then to avoid the malpractices there, what should we do? And it is here that we will criticize India constructively and pose some questions to ourselves. that for India’s bright future. What can we do?

Adani’s big Game

Adani’s business is based on three pillars: India’s growth, a lot of debt, and political connections. We learned about these three pillars in the second blog of this trilogy. But why is Adani building these pillars? Adani’s only objective is to become India’s biggest integrated player and offer solutions to corporations and governments. How will that happen? through vertical and horizontal integration. What does it imply? when one company in its own field acquires assets from other competing companies. Then it is referred to as horizontal integration. Today, through Adani’s ports, India’s 1/3rd cargo transport happens. Adani has so many ports. So naturally, their market share is quite high. Vertical integration means controlling all steps of production in a business. Basically, become your own manufacturer, your own supplier, and your own distributor; purchase from yourself and sell it to yourself only. Take Adani’s power as an example. Adani wants to generate power, so he has his own coal mines. He has his own ports for transporting coal. The transmission is also done by him. India will become independent or not, we don’t know, but Adani has become independent. Then what’s the problem? The obvious problem is that it requires a lot of money, and loans have to be taken. But apart from this, there is one more problem. It is said that you shouldn’t keep all your eggs in the same basket.

Today, Adani is too big to fail. many important projects, including ports, airports, solar power plants, and mines. So criticizing Adani is like an attack on India. India’s key to success must not go into the hands of just one corporate house. And for this, we have some laws in our country. In the Competition Act of 2002, he put some restrictions on which combinations would negatively impact free trade. Today, because so many projects are with Adani, Adani’s market share is very large. One monopoly is dangerous for customers like us. because then, whatever price someone quotes, we have to buy things at that price only. Adani Power provides electricity to my home. Now, if all over Mumbai we didn’t have any other electricity provider, then who would stop Adani from increasing its rates? Today, if I have frequent power outages at my home, I have the option of changing my distributor as a consumer. Tomorrow, this option may not exist, this is a simple example. But through this, you will understand why fair trade is important. When we did liberalization in 1991, we reduced restrictions in many sectors. This reduced government control, and businesses got an opportunity to grow. This was important for India’s future. but, for ambitious businesses like Adani, it also created a loophole. a loophole of monopoly, just think: I live in Mumbai, and if I want to catch a flight, I have to go to Mumbai Airport, which is under Adani’s control. Do I have any options? The term “eco-friendly” refers to the use of renewable energy sources.

Siphoning off Money

If you want to travel from one city to another and you Google it, you will see two routes. One is a long cut, which goes through a high way but has a toll in between, and the other is a shortcut. which is a Chris Cross Road, but there is no toll in between. most of the Jugadu Indians, will prefer the second route. Similarly, for a big company, this toll means taxes. which is very high in India, so these companies take a shortcut. The Hindenburg report says that Adani keeps rolling money into his ventures. According to the law, related-party transactions are not illegal. The most important thing is to stick to a simple formula. FMV stands for Fair Market Value. Assume Adani Ports receives refined oil from Adani Wilmar. but if it takes a 50% discount off even the wholesale price, then this is not a fair market value. All these companies may have the name Adani, but in the eyes of the law, they are different entities. You may believe that this is not a family, but rather a society in which different people live and work. It is now common for people to give each other discounts because of their relationships. But if I’m making a video for my father’s birthday and I’m not charging for it, that’s a different story, and it won’t work here. Why won’t it work?

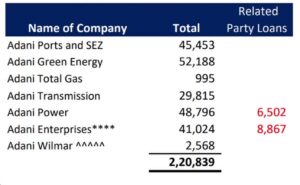

because from where does this discount come? from the profits of some companies. When one of Adani’s companies gives a discount to Adani’s other company at that time, it reduces its profit. Companies can misuse this to save their tax. to take out its money from a profitable company and investing it in a loss making company. This is the second loophole in the system. Look at the plan figures of Adani; here in Adani Power and Adani Enterprises, so much of the loan is shown through a related party. This can be a way to hide profit or else to move money, but nobody can be sure. In Adani Enterprise’s financials, we can see which subsidiary has taken how much of a loan. but who gave them this loan is not visible. then this question is very valid: from where did this money come? You must have read about this shell company in Hindenburg’s report. What is a shell company? A shell company is essentially a company that does nothing. It is simply a registered company with no employees. but money is moved through its accounts. Big corporations use shell companies to evade taxes. How?

First they find a country where the taxes are lower than in India or there is no tax. Then they set up a shell company there and transfer funds to it from India. It is mostly done through purchase transactions. These funds are given to other companies based in Mauritius as a loan, and from Mauritius, this money comes to India. but as foreign direct investment. A lot of money comes to India from Mauritius, most of it in the form of foreign direct investment, or EDI. which means that when foreign investment is made directly in some company’s shares or bonds, it is known as “foreign direct investment.” because the investment was made directly in a business. This same money is moved again and again to evade taxes. When an Indian company makes a payment to a foreign company, it claims it as an expense and shows that its profits are low. The foreign company must then pay less tax on this income than India, and the same funds are transferred to Mauritius as a loan. Some funds come to India as FDI, and again, there is no tax here either. This whole process is called roundtripping.

Consider this: you need to go to Europe for your honeymoon, so you can fly from here to Germany, and then from Germany to France. and you can come to India from France. Similarly, money is moved throughout the world. Again, is it illegal? no. From such tax-haven countries, India keeps getting such investment. and Mauritius is always in the top three. In 2017-18, 13.2 billion dollars were transferred from Mauritius to India. India is the world’s 5th-largest economy, and Mauritius is the 124th; still, these are the two largest economies. Which countries fund India? In 2021, even during the pandemic, Mauritius invested 5 billion dollars in India. Why does India not do something about it? As a country, we do DTAA with many other countries. Double Tax Avoidance Agreement (DTAA) means that the same income tax will not be charged twice. For example, suppose you moved to America and began working for a company there, earning dollars. You will then pay taxes in America rather than India. This is a loophole, and even after knowing about it, the government is not able to take any action.

India vs Shell companies

Taking shortcuts is not illegal. but it is a loss for tolling booths. To take action against shell companies, the big problem is that different companies have different laws, and depending on which country a shell company is based in, that company follows the laws of that country only. Before 2016, the Swiss Bank didn’t share its account holders’ details with other governments. because it’s their wish. So it became a hot spot for black money. Similarly, shell companies have become a source of concern for India. because Cyprus, the British Virgin Islands, and countries like Mauritius are not transparent. They don’t share information to keep the true ownership of the company a secret. because, in a way, these countries want money from India, which must come to their country. may be less, but they are able to charge tax on this money. Here, our foreign policy needs to be strong, and through this Adani case, we need to make changes in India’s rules and policies. so that not only Adani but no one else can benefit from these loopholes.

Then what can we do?

No country is perfect; it needs to be perfected, and cases like Adani and Hindenburg come up. It gives us an opportunity to go through Indian laws in depth. an opportunity to understand how many holes we have in our ship. which could become weak spots tomorrow and completely sink our ship, whether you’re on the left or right wing, everyone wants just this that, India doesn’t become a bagger, right? Determine where we need to improve.

No.1 Disclosures

According to the Hindenburg report, Adani does not properly disclose its related parties. and Adani says that he does everything, which is legally required. The truth is that there is a loophole in our accounting standard, which is exploited by Adani. and not only Adani; many companies do it. SEBI has said that family businesses exploit this loophole. SEBI began taking action on this in 2019, and stricter rules were implemented in 2021. As these regulations become stricter, regulators can take action more quickly.

No.2 Shell company's rules

Stopping shell companies and determining who benefits from them becomes extremely difficult. But there is some good news: in the case of Adani, the minister of Mauritius has said that they will fully support SEBI, and whatever documents are required will be submitted and disclosed. This is good news for India because it can be used to track down other shell companies besides Adani’s. This will disclose other shell companies too. India needs to go through its tax agreements so that if they need any improvements, then those changes are made.

No.3 Fair competition

Today, Adani falls into the “too big to fail” category. so tomorrow if Adani isn’t able to pay its loans. then the government has to use taxpayer money to save him. We don’t have an option; the correct way is to maintain competition in the market and ensure that no player becomes too big. that due to his loss, India has to face losses. At present, Adani is going in the direction of a complete monopoly. But, before we become an absolute monopoly, we must consider this.

No.4 Stock price manipulation

What was Adani’s previous relationship with Ketan Parekh? We have explained this in our first blog. But SEBI had banned Ketan Parekh only until 2017. why so? Can’t we introduce a lifetime ban? Stock price manipulation is a very serious allegation in Hindenburg’s report. and this must be investigated.

No.5 Corporate governance

The final point is crucial: corporate governance. and we all must keep an eye on it. Because SEBI discovered numerous irregularities in Adani’s business, and if stocks are delisted. then Adani will seriously be blown up, and recovering from that will be very difficult for Adani and India. and more than them, it will be very difficult for their share holders. because they won’t have the market to sell the shares. Many businesses in India are family-run. where many important roles are only assigned within the family. Usually, once businesses become big, their malpractices are ignored. Actually, the situation must be the opposite of that. In India, there are rules for corporate governance. but following it completely depends on the company. So if the company says that they have followed this rule, then one has a mechanism to check it. Keeping a check on companies and their practices is our responsibility. The companies that are listed on the stock exchange have to make their financials public. Why can’t we stop scams before they happen?

Because the truth is that we as a country must look at Adani’s issue from a long-term perspective, We must consider how we can permanently prevent such incidents. how can we reform our laws? and how can we take the nation on the path of sustainable growth? The truth is, is Adani right or wrong? People have already decided, according to their political ideologies. Some people have been waiting for the past nine years for a big scam to happen so they can prove that this government is of no use. and there are other people who are ready to ignore any problem. just in the name of nationalism. But what does the average person want? We simply want our ports to be efficient, our airports to function properly, and India to become a renewable energy superpower. And how will this happen? by asking the right questions and by reforming our systems.

1 thought on “What if Adani fails?”