Is Gautam Adani a hero or a villain for India?

Will Adani be over after the Hindenburg report? And will this man drown India? If you have the same questions, then this blog is for you. Hindenburg badly criticized Adani’s share prices and showed hundreds of flaws in their accounting, but is Adani’s business genuine? Hindenburg is silent on that.

today, we have to see, how powerful is Adani’s Business. Adani’s business is built on three pillars, if all three pillars are strong, then no report can damage Adani. but even if one pillar trembles, then it is worrisome.

How big is Adani?

When we see Adani’s net worth on a graph, then it is clear that this is not a joke. There are some dark secrets behind this. Last year, not only India but also Gautam Adani became Asia’s richest person, but how? Adani is big; everyone knows that, but exactly how big is it? Adani has seven companies. Adani’s formula is simple: in a developing country, invest in all those sectors that are important for its development and increase your dominance. Adani’s first pillar is investment in India’s future. By 2025, India will be the 3rd largest country with air traffic; Adani knows this.

Today, Adani is India’s largest airport operator. Operation management and development of seven airports are handled by Adani. Interesting part is that Adani got into the airport business only 3 years ago. and today, 1/3rd of air traffic goes through some or the other airport handled by Adani. 1/4th, or 25%, of cargo coming into India goes through a port owned by Adani. Adani is India’s largest coal trader and also the country’s largest edible oil importer. Do you know what this means? When we talk about airports or cargo ports, Adani’s biggest rival is not Tata or Birla. instead its the Indian Government itself and that’s why in September 2022, he wealth had reached 141 billion dollars and before the Hindenburg report. it was 124 billion dollars, after Hindenburg it has dropped to $50 billion.

Let’s see his journey’s timeline and come to a point, after which his wealth got a nitro boost. In 1978, Gautam Adani started working during his teenage years, left his college education in the middle, and came to Mumbai. Here he used to sort diamonds. In 1981, he came back to Ahmedabad; his brother had purchased a plastic factory, and Gautam Adani started helping him. but they needed such PVC material, and IPCL was not able to deliver it on time. So in 1988, Gautam Adani started importing such plastic granules for himself and not only for his business but also for others. this business was started only with 5 Lakhs capital, and in the next 4 years, his imports grew by 400%.

In 1994, when Adani Exports was listed on the stock market, business was going nicely, but losses also increased. because all the imports were happening through Kandla or Mumbai ports. The next step was to have my own port. Mundra Port’s situation was also ideal. In 1991, economic liberalization happened in India. and India was finding private partnerships in ports. Adani won this contract in 1995, in his infrastructure journey, this was the 1st biggest win. simultaneously, he started developing connections with politicians of Gujarat. by 2000, the total turn over of all his companies crossed 3000 crores. but his biggest investment came in 2002. when riots happened in Gujarat and the CII stepped back from investing in that state. then Adani invested 1500 crores in Gujarat. On one side, Gujarat continued growing, which gave India a new prime minister, and simultaneously, Adani also grew power plants, mines, airports, solar power, edible oils, and media. He tried his hand in different fields.

Why did I tell you this whole story? Not to emotionally blackmail you, but to tell you how this extraordinary growth happened.

Secret of Adani’s growth

Did such thing ever happened with you? that you went into the mall to buy one pair of jeans and, after 4 hours, came home with five shopping bags. If yes, then you have a happy day of shopping. Similarly, Adani has a hobby. hobby of buying companies, Adani has bought many companies over the past 10 years. Why? Because if one wants to enter a new business, it takes time to become an expert there; growth is slow, and slowly, one becomes a competitor in that business. This is known as the organic method of growth. but better than this is, to buy a company which is successful in that sector. then their assets are yours, their market share is yours, and their expertise is also yours. this is known as inorganic method of growth, this is the fastest way of growth. which is Adani’s favorite, but there is a small problem in this: that it requires money, a lot of money, and from where will this money come? Debt is Adani’s second pillar. if you look at Adani’s projects ports, solar power plants, mines. All of them are capital-intensive. which means, first, you have to spend a lot of money; you have to develop the infrastructure; and as time passes, money starts flowing in.

From where will this capital come? through debt, taking a loan to buy companies is not an uncommon thing. Let’s take an example Elon Musk bought Twitter for 44 billion dollars. Elon Musk has a lot of money, but he is not going to buy Twitter. through his own money. He took out a loan of 13 billion dollars, and he has to pay 1.5 billion as interest every year. If Elon Musk is able to make Twitter profitable, then it is fine. otherwise he would be bankrupt, because the funda is simple. Through debt, if you buy something that is profitable, which means an asset, then it is a good debt. But if you buy something that is not profitable, you will drown in debt.

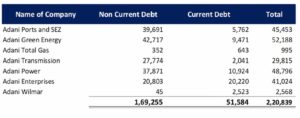

Last year, a company named Credit Sights flagged off the high debt of the Adani Group. Market participants knew that the Adani Group has taken a lot of loans. Because growing so fast without debt is not possible, the total debt of the Adani Group is 2.2 lakh crores. This number sounds very high. In fact, one report claimed Adani’s debt to be 1% of India’s economy. Now, let’s look into their financials and see which company has taken on how much debt. Let’s have a look at this chart. Adani Green has taken on the highest debt. that is 52000 crores, number 2 is Adani Power at 48000 crores, and number 3 is Adani Ports at 45000 crores. after looking at this table we come to know, that Adani is going to repay 51000 crore debt, this year 2022-23 it self, and the rest over the long term. if you read news reports, then Adani group has borrowed around 80000 crore in debt, we can see that 51000 crores has come through bonds and debentures, Majority of Adani debt is secured debt, which means against this loan. He has mortgaged his assets or shares. If the loan is not paid in time, then banks can sell these assets and recover their money. So when Hindenburg says that, Adani is pulling the biggest con in corporate history. If we look at it, he is not scamming the banks; the loans and bonds, which are unsecured, are at risk. but this thing is not limited to Adani group only.

In 2020, a mutual fund named Franklin Templeton closed six of them. Because they had invested in some risky bonds, unsecured investments are risky; it may be any company. after understanding this whole story. Let’s come back to Hindenburg. Everyone is making noise under Hindenburg’s name. but the real problem is that Hindenburg’s allegations, were not tackled well by Adani, Hindenburg’s report came recently, but those people who work in finance. For those who take their salary to study companies like Adani, Hindenburg’s report does not matter at all. half the things were known to them already, how? Adani’s financial statements show that there is risk in the group; even after knowing this, banks gave them money. why? The answer is connections.

Adani and the Government love story

The government is Adani’s biggest client. because he is making many projects for the government. and the usual understanding is this, that the money coming from the government can be late, but can never be defaulted, this gives an assurance to banks. Our favorite, Rahul Gandhi, showed these photos in Parliament. Narendra Modiji is seen with Adani; a good amount of drama happened on this, and the time to discuss important things was over. but there are some more images. which are important for you to see like these, where Adani is seen with like there, where Adani is seen with Rahul Gandhi’s brother in law, or there images which are with Bengal’s CM. If we search a little, then with every politician, we can find some image of a big businessman; one photo doesn’t prove anything. but yes, what is happening in India’s politics, to understand that, you don’t have to look at any photo. Just imagine if an industry gave money to the government for its own benefit. Expects changes in their policy, gives favour to them. and most importantly, expects favors from them. then you will call such a system corrupt.

but in the United States of America, it is completely legal, and it has a good name too lobbying. Lobbying means influencing the government. America’s constitution allows lobbying. So it is legal in America, but how ethical is it? how do companies use this right? the funda is simple, election needs campaigning, candidate may be good or bad. If the campaigning is not done right, then the election is a failure. these lobbyists funds the elections of Candidates and once their candidate wins the elections, they get favourable laws passed for their industry. OpenSecrets is a website where you can see which companies and which groups are spending how much money on lobbying. Companies like Meta and Amazon are also included in this. to get favorable laws from the government. These companies spend millions of dollars every year. These are oligarchs in Russia, rich business families that have maintained their power in business and also in politics. Lobbying happens in America, where it is widely accepted; a similar system exists in India too.

Traditionally political parties used to fund, their campaigns only through two ways.

- Membership fees

- Private donations

The “Representation of the People Act” states that any political party can accept donations from any corporation; this act was passed in 1951. The interesting part is that our income tax act, under Section 80 GGB for donations given to political parties, provides tax deductions as well. which means if you donate to political parties, you have to pay less income tax. Due to such loopholes, even after demonetization, few politicians were affected much. the points being India and America too has such systemic flaws, which create a link between political and corporates, due to which frequently, different political parties work in favour of different companies. Atal Bihari Vajpayee once told a parliamentary committee that every legislator starts his career with a lie as to how much he spent on his elections. This is a systemic problem, and in this matter, nobody is clean.

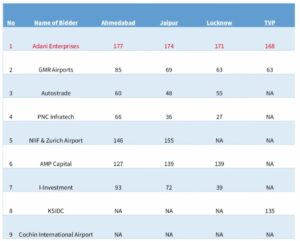

from the past 15 years Different political parties received 14651 crore rupees in anonymous donations. Let’s come back to Adani. It is said that the government has no business doing business. but many times for public good. The government has to do business here instead of taking on the whole burden. The government forms partnerships with private players. so that the risk is distributed, it is known as a PPP (public-private partnership). In 2019, the government issued tenders through PPP for the operation of a few airports. Airport operators submitted their bids, and Adani got six airport contracts. The point to be noted is this: that they won these bids, surpassing GMR, which has more experience in airport operations. The Department of Economic Affairs had made a suggestion to the government at this time. that operating and developing an airport is a capital intensive work Basically, it requires money.

So, don’t give more than two contracts to one player. NITI AAYOG had also supported this, but Adani’s bids were so aggressive. that the government awarded the contracts to them. and for the next 5o years, they were given to operate all these airports. The important question is why? answer is clearly visible in their bids. The thing is, whichever bidder finally gets this contract, he has to give a per-passenger fee to the Airports Authority of India. which means if one passenger passes through that airport, then Rs. X is to be given to AAI. Look at this chart, there’s a lot of difference between the bids of Adani and others. How can Adani give such good bids? pillar no. 2, due to debt. Connections are Adani’s third pillar.

Conclusion

Usually, whenever one has an opinion on Adani, they try to understand his story according to their ideology. Some people just look at the first pillar, pointing at Adani and India’s growth, and they want Adani to be successful. because they want to see India rise. Some people look at the rising debt and think that’s true even today. they wat scams happened in this country, similarly it will happen in future too. But it is important for all three pillars to be strong. If even one pillar is weak, then Adani’s structure will fall. see it doesn’t matter, what is your political affiliation. if Adani or any big company fails. then its impact happens on the whole country. then no one will ask you: do you support the left or right wing? We cannot hope for a scam. At the same time, we cannot ignore the signs of a scam. Then what should we do? support Adani blindly? absolutely not.

Through this blog, we are encouraging you to ask the right questions, keep your eyes open, and see. Which Adani projects are going near you, and are those projects finishing on time? If the projects are already started, how are they performing? because if these projects are successful, then he will be able to repay the debt, and ultimately India will benefit. Accountability is the word, frequently our leaders without coming to the point, without talking about economics keep on arguing round and round. which has no conclusion, and by doing this, the right questions are ignored, and people like Nirav Modi, Vijay Mallya, and R Raju become big. They create a financial bubble, and the nation suffers once this bubble bursts. They exploit the systemic flaws and loopholes we have in our laws and then run away from the country. No one country is perfect, and if that country is a democracy, then no, at all. Is American democracy perfect? No, but America got its independence 245 years ago, which means that for their democracy to mature, they have had 3x more time than us if they have lobbyists. then they also activists who counter them. which work on increasing transparency. India must have such systems too. So we know which business is funding which party. Even though we need to mature, we don’t have 200 years for this; we only have 5–6 years. Support constructive criticism.

one thing is for sure, when Gautam Adani’s story will be written, it can have only 2 titles

- A common man who becomes who become world’s richest man

- India’s biggest con man

1 thought on “Will Adani be over after the Hindenburg report?”