Close shave in Silicon Valley Bank crisis

A scam that will impact 8 billion people in the world, and the thief will go free without any punishment. Since the last 2 weeks, you may surely have heard one name Silicon Valley Bank. which is one of America’s top 20 banks, which became beggars overnight. But the scam is not that people’s money got washed away. the scam is that people are going to get back all the money. confused? you should be. I will explain everything. You don’t need to be an economist to fully understand the story. One needs to remember this pyramid, at the three points of which the three villains are sitting. Who betrayed America as well as the world. So let’s know, will Silicon Valley survive the bank crisis?

What is going on

There is a saying, “When America catches a cold, the whole world sneezes.” this means that despite being 10,000 kms away from us, the economic earthquake that occurs in America shakes the homes here. let me explain. in the last 10 days America’s Banking system has been shaken. Silicon Valley Bank has sunk. To understand how SVB sank, in fact, it will settle in three lines. SVB, where many startups like VOX, Vimeo, and Roblox keep their money, took their money and invested it in the wrong place. thought that the economy was going great guns. These startups will raise more funding and will not touch their deposits. but the opposite happened. Startups started withdrawing their money. now because of the bank run, SVB came to a point and said, money’s over. What is the important thing? and why did this bank sink?

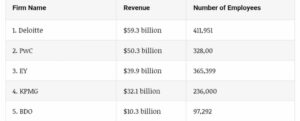

Firstly, it is not about just one bank. after SVB signature bank and first republic bank, both are over. so not just one bank, it questions the entire banking system and secondly because of this one event everyone will be impacted. whether you are a startup or not, whether your money is in your pocket or in the bank. What does it mean? let’s understand. SVB was not a street corner co-operative bank. ICIC Bank has assets of US $230 billion, and SVB’s are US $209 billion. that is the bank was big. Forbes called it one of the top banks for the last five years. KPMG is one of the largest accounting firms in the world. 15 days before the bank collapsed, gave a clean audit report to the bank and said that bank’s health is good. So, brother, whom should a customer trust? an educated investor will also refer to these reports. and that’s what startups did. 50% of America’s tech startups had opened accounts in SVB. many startups from India also had kept their money in SVB. and when this bank closed, they couldn’t withdraw money from their account. Those funds got locked.

The companies did not have the money to pay the salary to the employee or to pay the office rent. why did this happen? because of this pyramid, on whose three points, that is three reasons are seating.

America’s three Villains

There is a villain in every story. but here are the villains. The first villain is free money, thanks to the Fed.

The first villain is free money

A great man has told the truth. what is money? Money is the dust of the feet. America’s Fed took this advice a bit too seriously. fed, or federal reserve. This is America’s RBI, or Central Bank,” whose job it is to set America’s monetary policy. there was financial crisis in 2008 and they reduced their rates. What happens is that a country’s central bank becomes its backup bank. if a bank doesn’t have money, so if can borrow money from the backup bank, can repay the customer’s money. After 2008, American banks were in trouble. so Fed dropped its rates from 5% to 0.1%. What does it mean? Money has become cheap. did not understand? I will explain everything. When the central bank lowers its rates, our neighborhood bank also reduces its rates. Now if you want to buy a home and you want to take out a loan, you’ll go to the bank. you’ll see what the interest rate of the loan is going on? then you will sit down to calculate. how big a house can you afford? If the prevailing interest rate is 7% and you took a loan of Rs 1 crore, you would pay Rs 1.8 crore over the course of 20 years. this 80% lakhs is interest, which you give extra to the bank.

Now, after seeing such a huge amount, what would you think? no man this is a lot of money, i’ll look for a slightly cheaper house. You will reduce your budget and try to save money. when the interest rate is high, then people think just like this. but what happens when the interest rate falls? Exactly the opposite what if this home loan rate goes straight from 7% to 2%? You have to pay only Rs. 2 crore in 20 years on a loan of Rs. 1 crore. so you will think, okey. Let’s take 3 BHK instead of 2 BHK. your budget increases, so does the demand for houses. The rate at which people will get the loan is linked to the Fed’s interest rate. Banks lend to people by adding some percentage to the fed rate. The Fed cut its rate down to 0.1% after 2008, increased demand in the market, and gradually increased this rate. as the economy slowly stabilized, then came the pandemic, and the Fed did the same, which they know to do best. made money cheap, reduced their interest rate to 0.05%. What does it mean? Taking loans from banks for investors made investing in startups easy. got cheaper.

back to the Silicon Valley bank. an image of SVB was formed, that it is a startup friendly bank. In terms of numbers, in March 2020, they had deposits worth $60 billion. this number had increased to $200 billion in two years. that means more than triple. In 2020, the US government injected a stimulus of $4 trillion into the economy. people got cash transfers. Businesses got cheaper loans. And where did this extra money come from? fed printed this money overnight. Many economists warned that due to these rash decisions, inflation would increase. But the Fed said no, this inflation is temporary and will get done with. and when inflation started rising every quarter, the Fed started panicking. and then immediately, in 2022, the Fed started raising interest rates. the rate which was so low as 0.05% increased 88 times in one year. New loans did become costlier, and along with this, those people who had taken loans at the time of the pandemic even saw their interest on those loans increase. Everyone’s plans got ruined.

The second villain is Company management

SVB thought that the pandemic would last longer and that the Fed would not increase interest rates so soon. So they started investing their customers’ short-term deposits in long-term bonds. for example, taking the money you have in savings that you started investing in an instrument that would give some returns after 5 years. while doing this, their assets worth $91 billion got stuck. Banks have a risk department that analyzes and manages the risk of their investments and accordingly advises the bank. SVB’s risk officer had resigned in April 2022 itself, and no replacement was found for 8 months. that is, to calculate the investment risk. there was no one in the bank for 8 months. When the Fed raised the rate, startups weren’t able to raise new investment. A startup winter had begun. That is, for its operations, it slowly started withdrawing its old money from its deposit. SVB was surviving on just one hope that everyone would not withdraw their money at the same time. because they had customer deposits worth $173 billion but only $13 billion in cash. when his cash reserves gradually dwindled. It sold its long-term bonds and booked a loss of $1.8 billion. it disclosed this on 8th March and also disclosed that they want to raise a capital of $2.5 billion. This caused panic in the market, and all the venture capitalists told their startups to withdraw money from SVB immediately. Depositors tried to get $42 billion out of the bank, but did the bank have this money? No way. So the bank tried to stop the withdrawals. The interesting thing is that just a few days before this bank run, the company’s high-level management sold $4 million’s worth of stock. that is they knew that the bank was going to collapse stock prices are about to fall.

The third Villain is Lobbyists

No bank can survive such a complete bank run. That’s why some reverse has to be kept. After the financial crisis of 2008, a law was passed to save the US banking sector. Which are called Dodd-Frank Acts. There are strict rules about where banks can invest. Every bank has to go through stress tests. So that he doesn’t drown. SVB CEO Gary Backer hired Lobbyists. So that he gets his bank’s provision removed. He said that SVB is a very small bank compared to other banks. So there should not be such restrictions on them. We fund startups, so we should have some flexibility. We are going to make America great. Lobbying was successful. Because in 2018, these rules were relaxed. Bank whose total assets were less than $250 billion dollars. He was exempted from this stress test. Stress tests predict different scenarios so that banks can take better decisions. But lobbyists don’t ensure that this rule doesn’t apply to small banks like SVB. He spent $1 million dollars for this lobbying. So basically, the regulations could have saved them from this mess. They have been put into that option only.

What is the Scam?

This whole crisis reminded America of the 2008 financial crisis. and America can do anything to avoid that same crisis. That is, in the long term, it can ruin the entire economy. President Biden himself said in an interview that depositors will get a 100% bailout. but the shareholders of the bank will lose all their money. If any bank sinks in India, you get only Rs. 5 lakh in insurance. by the way in America you get an insurance of $2,50,000. SVB’s 97% of deposits were over $2,50,000. Biden said that the depositors will get all their money. the one who was not insured that too. Didn’t have insurance, and the bank didn’t have money, but everyone will get full money. how? How did this magic happen? Here the government committed $167 billion, that too out of thin air. and for this printed $300 billion overnight. What is money? Money is the dust of the feet. everything is illusion. This scam raises many questions. Is this only for SVB Bank? or when other banks also fail, will they also get the same facility?

Fed started a new program called the Bank Term Financing Project. Under this project, banks can pledge their long-term securities with the Fed and borrow money. but it has a very interesting catch. Fed will give banks their cost price in exchange for their long-term assets even if their market price has fallen. In simple language, Fed says that this is my phone, which I bought two years ago for $50,000. If I go to sell it today, it will not even fetch Rs. but if i need money today then Fed will take this phone from me and give me Rs.50,000. So cool, right? and the central bank of the country tells its banks keep some of your reserves with me. When the need arises, there will be no problem accessing the funds. in India this is called Statutory liquidity Ratio. earlier this ratio was 25% and now it is 18%. This means, apart from cash and investments, banks keep 18% of their reserves with the RBI.

in USA, Fed reduced these requirements to zero in 2020. So now the banks do not have any incentive to keep the money in reserves. which means this situation can completely blow up. in fact research says that US banks are sitting on unrealized losses of $620 billion. means if they sold their investments this much damage can happen. that is the total value of this scam is US $620 Billion. making it larger than the GDP of 190 countries.

Conclusion

what will America do now? It has two options. Will they start printing money for every bankrupt bank? or let them drown? whenever the US Federal Reserve prints money, inflation increases indirectly in the USA, and the US dollar is the international reserve currency. so it also somewhere impacts the value of our Indian rupee. this means that somewhere or the other we also have to pay the price for their mistakes. Inflation is an indirect theft, due to which the value of the money in your pocket decreases. This is what is going to happen because of these American decisions: the supply of dollars will increase in America. but things are limited. so the prices of things will also increase. Whatever we as Indians import, their prices will increase because we make payments in dollars. and we and the whole world will have to pay the price for it. That is the cost of mistakes by banks like SVB. Even those people will have to pay those who have never even heard the same name as SVB. If this is not theft, then what is?

Now American tech companies are doing layoffs, and a recession-like situation is in the market. also printing so much money overnight can lead to hyperinflation experts say so. Now, what will be the impact of this misappropriation of money on India and on the whole world? an important lesson for India is that often we do not give importance to the decisions of our economists and policy experts and search for foreign validation and suggestion. “With great power comes great responsibility.” This line is from an America movie, but America itself never took this advice seriously. Dollar is the backup currency of the world as long as the dollar continues to dominate world trade until then, in one way or another, we will remain slaves of dollars.